POWDR Settles Surcharge Lawsuit at Copper Mountain

Popular Stories

A customer’s legal challenge to Copper Mountain’s resort surcharge has come to a close.

POWDR Corp., the parent company of Copper Mountain in Colorado, reached a settlement with Gary Chaney, the customer who filed a class-action lawsuit challenging the legality of surcharges added to food and beverage purchases at the resort. The two sides announced the settlement in a joint court filing on Nov. 26. They did not disclose the terms.

As first reported by Summit Daily, POWDR Vice President of Communications Stacey Hutchinson said the lawsuit “was resolved to the satisfaction of both parties.” Neither POWDR nor Chaney’s legal team offered further details. POWDR had previously labeled the lawsuit “baseless.”

Consumer Protection

Chaney filed the lawsuit on May 12, arguing that Copper Mountain violated the Colorado Consumer Protection Act by advertising menu prices that did not reflect the total amount charged at checkout. The complaint accused the resort of deceptive trade practices for adding surcharges that were not clearly disclosed to customers.

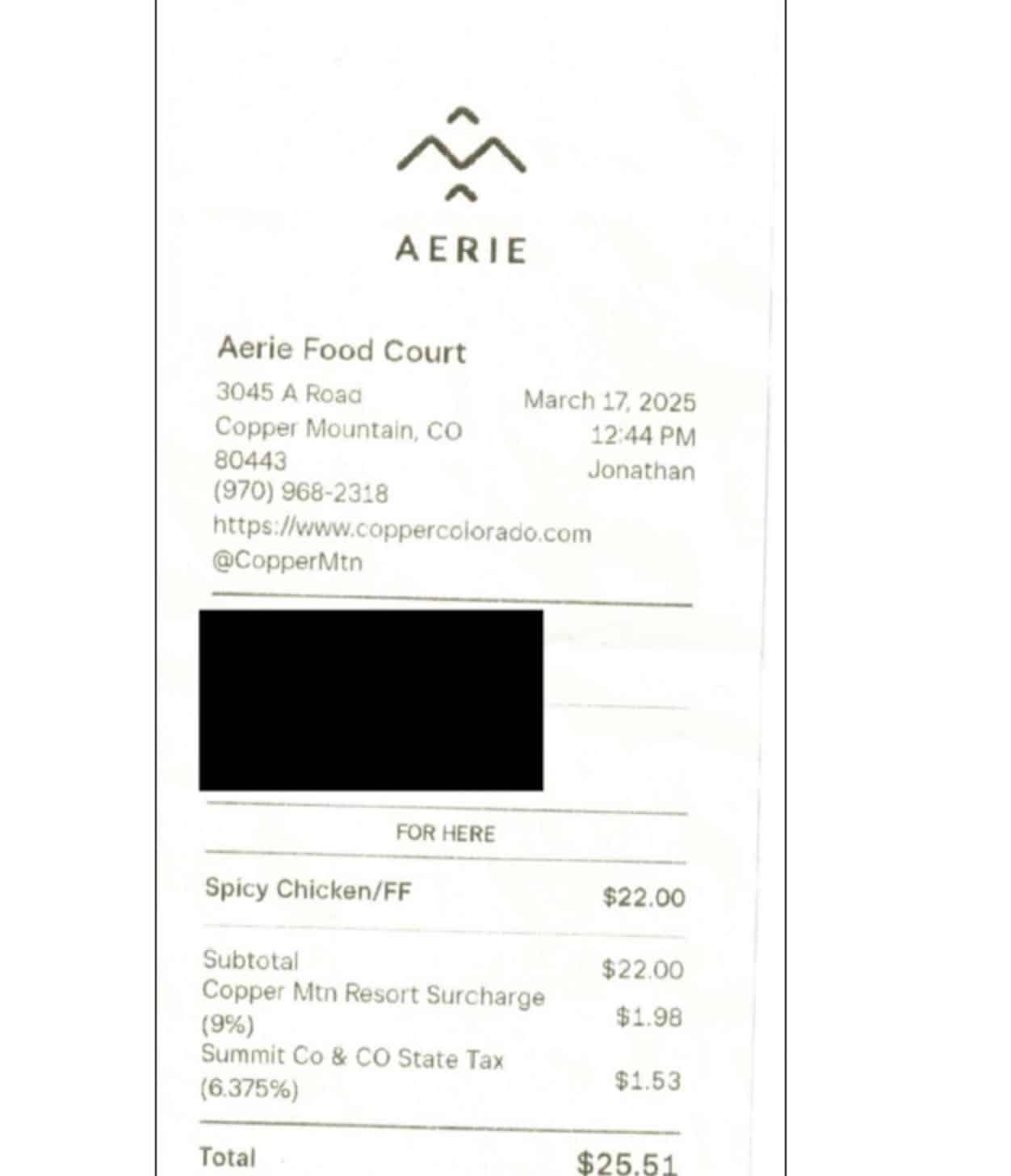

The lawsuit alleged that Copper Mountain routinely added a surcharge of up to 7 percent to food and beverage purchases, on top of standard sales tax. During peak spring break periods, the surcharge allegedly climbed to 9 percent. Chaney’s filing included photos of menus that did not mention the surcharge, along with receipts showing the added fees, which he claimed customers often received only upon request.

A Spicy Situation

One example cited in the complaint involved a $22 spicy chicken order at the Aerie Food Court. The surcharge added $1.98 to the bill, and after taxes, the total came to $25.51.

Credit: Summit County Courts

At the core of Chaney’s argument was the claim that the resort surcharge was not a government-mandated tax or fee and therefore required clear disclosure before purchase.

Sign Up for the TGR Gravity Check Newsletter Now

“Unlike Summit County and/or Colorado State Sales Tax, the Copper Mountain Resort Surcharge is not a government-mandated tax,” the complaint stated. “The Copper Mountain Resort Surcharge is an additional revenue source POWDR uses to support its business operations and satisfy its private contractual obligations.”

By filing the case as a class action, Chaney aimed to represent other customers affected by the surcharge, seeking monetary damages and a court order to stop what he described as deceptive pricing practices.

POWDR denied the allegations and, by settling the case, admitted no wrongdoing.

Court records show that both parties plan to file a joint stipulation to dismiss the lawsuit with prejudice within the next four weeks. A dismissal with prejudice prevents the case from being refiled.

While the settlement closes this specific dispute, questions around resort fees, pricing transparency, and consumer expectations in ski towns are likely to persist.